Support our educational content for free when you purchase through links on our site. Learn more

Can You Mine Crypto on Your Own? The Ultimate 2025 Guide 🔥

Thinking about diving into the world of crypto mining solo? You’re not alone. The idea of running your own mining rig, striking digital gold, and keeping 100% of the rewards sounds like a dream come true. But is it really that simple? Spoiler alert: solo mining is a thrilling rollercoaster with massive potential rewards — but also steep challenges and risks.

In this guide, we’ll unravel everything you need to know about mining cryptocurrency on your own in 2025. From the evolution of mining hardware and the best coins to mine solo, to the hidden costs and legal hurdles, we’ve got you covered. Plus, we’ll share real stories from miners who’ve been there, done that — including the good, the bad, and the downright surprising. Curious about how long it might take to mine a Bitcoin solo, or whether your home PC stands a chance? Stick around; the answers might just blow your mind.

Key Takeaways

- Solo crypto mining is possible but extremely challenging for major coins like Bitcoin due to massive network competition and hardware demands.

- Specialized ASIC miners are essential for Bitcoin, while GPUs work best for many altcoins that are ASIC-resistant.

- Electricity costs and hardware setup are the biggest factors impacting profitability and success.

- Mining pools offer a more reliable way to earn crypto, but solo mining gives you full control and the entire block reward if you win.

- Legal regulations vary worldwide — always check your local laws before starting.

- Solo mining is best suited for hobbyists, tech enthusiasts, or those mining smaller coins with less competition.

Ready to find out if solo mining is your golden ticket or just a costly gamble? Let’s dig in!

Table of Contents

- ⚡️ Quick Tips and Facts About Solo Crypto Mining

- 🔍 The Evolution of Cryptocurrency Mining: From Hobby to Industry

- 💡 What Exactly Is Crypto Mining and How Does It Work?

- ⛏️ Why Do Cryptocurrencies Need Miners? The Backbone of Blockchain

- 💰 Why Should You Consider Mining Crypto on Your Own? Pros and Perks

- 🛠️ What You Need to Start Mining Cryptocurrency Solo: Hardware, Software, and Setup

- 1️⃣ Top 7 Best Cryptocurrencies for Solo Mining in 2024

- 2️⃣ Step-by-Step Guide: How to Mine Crypto on Your Own Successfully

- ⚡ Power Play: Managing Electricity Costs and Environmental Impact

- 📉 The Hidden Downsides of Solo Crypto Mining You Should Know

- 🌍 Legal Landscape: Where Is Solo Crypto Mining Legal or Banned?

- 🤔 Can Anyone Really Mine Crypto on Their Own? Debunking Myths and Realities

- 🕵️ ♂️ Privacy and Security: Can Solo Crypto Mining Be Traced?

- 🔧 Maintenance and Troubleshooting: Keeping Your Solo Mining Rig in Top Shape

- 📈 How Long Does It Take to Mine One Bitcoin or Other Coins Solo?

- 💡 Alternative Mining Strategies: Pools, Cloud Mining, and Hybrid Approaches

- 💬 Real Stories: What We Learned From Solo Miners Around the Globe

- 🔚 The Bottom Line: Is Solo Crypto Mining Worth Your Time and Money?

- 📚 Recommended Links for Aspiring Solo Miners

- ❓ Frequently Asked Questions About Solo Crypto Mining

- 🔗 Reference Links and Resources

Here is the main content for your article, crafted by the experts at Coin Value™.

Body

⚡️ Quick Tips and Facts About Solo Crypto Mining

Welcome, fellow crypto enthusiasts! You’ve asked the golden question: “Can you really mine crypto on your own?” The short answer is yes, you absolutely can! But the longer, more important answer is… well, it’s complicated. Before we dive deep into the digital mines, here are some quick takeaways from our team at Coin Value™ to get you started. And if you’re looking for the path of least resistance, check out our guide on How to Mine Bitcoin at Home for Free: 7 Smart Strategies! 💡 2025.

- ✅ Solo Mining is Possible: You can, in theory, set up your own hardware and find a block all by yourself, keeping the entire reward. It’s the ultimate crypto lottery ticket!

- ❌ It’s Incredibly Difficult for Bitcoin: For major coins like Bitcoin, the network’s total computing power (hash rate) is astronomical. A single home setup has a minuscule chance of finding a block. As Investopedia puts it, “The chances of receiving any reward by mining alone with a single GPU in your computer are minuscule.”

- 💰 The Reward is Huge (If You Win): If you do manage to find a block solo mining a major cryptocurrency, you keep the entire block reward plus transaction fees. For Bitcoin, that’s a life-changing amount of crypto.

- ⚡ Electricity is Your Biggest Enemy: Your profitability hinges almost entirely on your electricity cost. NerdWallet states, “The cost of electricity is the biggest factor in determining whether bitcoin mining is profitable.”

- 🖥️ Hardware Matters… A Lot: Gone are the days of mining Bitcoin on a laptop. Today, you need specialized machines called ASICs (Application-Specific Integrated Circuits) for any serious attempt.

- 🤔 Alternatives Exist: If solo mining sounds too daunting, don’t worry! Mining pools and cloud mining offer more accessible ways to get involved in Crypto Coin Mining.

- ⚖️ Check Your Local Laws: The legality of crypto mining varies wildly around the world. Always research your local regulations before investing a dime.

🔍 The Evolution of Cryptocurrency Mining: From Hobby to Industry

Remember the good old days? Back in 2009, you could mine Bitcoin on a standard home computer (a CPU). It was a niche hobby for cypherpunks and tech dreamers. We remember a friend of ours firing up his old Dell desktop and earning a few Bitcoin while he slept. If only he’d held onto them!

But as the value of Crypto Coins like Bitcoin grew, so did the competition. The mining landscape evolved at a breakneck pace:

- CPU Era (2009-2010): The earliest phase, where anyone with a computer could participate.

- GPU Era (2010-2013): Miners discovered that Graphics Processing Units (GPUs), the cards that power your video games, were far more efficient at the specific math required for mining. This kicked off the first mining “arms race.”

- FPGA Era (2011-2013): A brief, transitional period where more specialized hardware (Field-Programmable Gate Arrays) offered a power-efficient edge over GPUs.

- ASIC Era (2013-Present): The game changed forever with the arrival of ASICs. These are custom-built chips designed to do one thing and one thing only: mine a specific cryptocurrency algorithm. They are thousands of times more powerful than GPUs, making GPU mining for Bitcoin obsolete and turning the hobby into a full-blown industry dominated by massive data centers.

This evolution is the core reason why solo mining Bitcoin is so tough today. You’re not just competing with other hobbyists; you’re up against global corporations with warehouses full of the most advanced technology.

💡 What Exactly Is Crypto Mining and How Does It Work?

So, what is this “mining” we keep talking about? Is it like digging for digital gold? Metaphorically, yes! But in reality, it’s a bit more technical and a lot more fascinating.

At its heart, crypto mining is the process of validating transactions and securing a cryptocurrency network. Think of miners as the decentralized accountants for a blockchain like Bitcoin. When someone sends Bitcoin, miners around the world race to do three things:

- Verify: They check the transaction to make sure it’s legitimate.

- Bundle: They group thousands of transactions together into a “block.”

- Solve: They compete to solve an incredibly complex mathematical puzzle related to that block.

The puzzle involves taking the block’s data and repeatedly running it through a cryptographic algorithm (like SHA-256 for Bitcoin) to find a specific type of answer—a “hash” that starts with a certain number of zeros. The only way to find it is through brute force: guessing trillions of answers per second. The first miner to find the correct hash gets to add their block to the blockchain and claims the reward.

This “puzzle” has a difficulty level that the network automatically adjusts every 2,016 blocks (about two weeks for Bitcoin) to ensure a new block is found roughly every 10 minutes, no matter how many miners join or leave the network.

⛏️ Why Do Cryptocurrencies Need Miners? The Backbone of Blockchain

Why go through all this trouble? Why not just have a central server run by a bank? That’s the magic of decentralization! Miners are the essential backbone that makes cryptocurrencies like Bitcoin work without needing a central authority.

- They Process Transactions: Without miners, transactions would just float in limbo, never being confirmed or added to the official ledger.

- They Secure the Network: This process of solving puzzles, known as Proof-of-Work, makes the blockchain incredibly secure. To alter a past transaction, a hacker would need to re-mine that block and all subsequent blocks faster than the rest of the network combined—a feat requiring an impossible amount of computing power.

- They Create New Coins: Mining is also how new coins are introduced into circulation. The block reward serves as the incentive for miners to spend their time, money, and electricity securing the network. It’s a beautifully designed self-sustaining system.

💰 Why Should You Consider Mining Crypto on Your Own? Pros and Perks

With all the competition, you might be wondering, “Why would I even bother?” It’s a fair question! While the odds are long, the potential rewards and personal benefits of solo mining can be alluring.

The Ultimate Jackpot: The Full Block Reward

This is the number one reason people attempt to solo mine. If you join a mining pool, you get tiny, consistent payouts. But if you successfully mine a block on your own, you keep the entire reward. As Cointelegraph notes, “If you do find a block on your own, you keep the entire reward… There is no need to split the payout with anyone else.”

Let’s look at Bitcoin’s reward history, a phenomenon known as “the halving,” where the reward is cut in half approximately every four years:

| Year of Halving | Block Reward |

|---|---|

| 2009 | 50 BTC |

| 2012 | 25 BTC |

| 2016 | 12.5 BTC |

| 2020 | 6.25 BTC |

| 2024 | 3.125 BTC |

| 2028 (Projected) | 1.5625 BTC |

Even with the reduced reward, mining a single Bitcoin block solo is a massive financial windfall.

Other Perks of Going Solo

- No Pool Fees: Mining pools take a small percentage of your earnings for their service. Solo miners keep 100% of what they earn.

- Total Control: You have complete control over your hardware and software configuration.

- Educational Experience: It’s an incredible way to learn about the inner workings of blockchain technology and network security.

- Supporting Decentralization: Some purists mine solo to contribute to the network’s decentralization, even if it’s not profitable.

🛠️ What You Need to Start Mining Cryptocurrency Solo: Hardware, Software, and Setup

Ready to build your own digital money-printing machine? Hold your horses! You’ll need the right gear. The days of using a simple laptop are long gone. Here’s what our team at Coin Value™ considers essential for a modern solo mining setup.

The Heart of the Operation: Mining Hardware

Your choice of hardware is the single most important decision you’ll make. It determines your hashing power, electricity consumption, and ultimately, your chances of success.

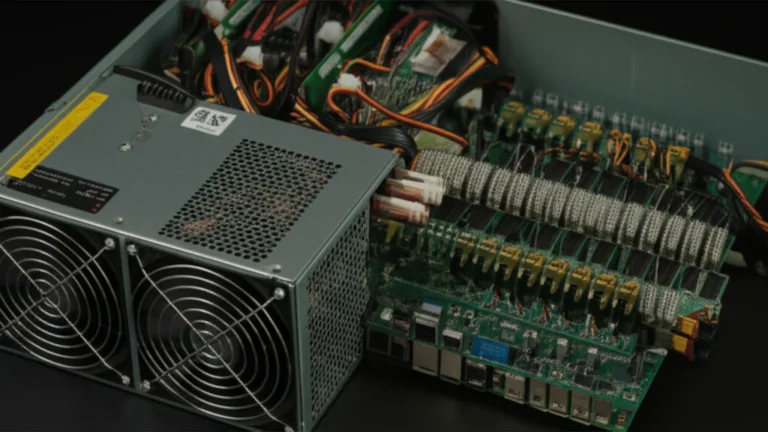

ASIC Miners (The Heavy Hitters)

For mining Bitcoin and other SHA-256 coins, ASICs are non-negotiable. These are loud, hot, power-hungry beasts designed for pure performance.

- What they are: Custom-built machines with chips designed solely for mining.

- Pros: ✅ Unmatched hashing power and efficiency for their specific algorithm.

- Cons: ❌ Expensive, generate immense heat and noise, and can only mine one type of algorithm.

- Top Brands: Bitmain (makers of the Antminer series) and MicroBT (makers of the Whatsminer series) are the industry leaders. The Antminer S21 Hydro is a modern example of a top-tier machine.

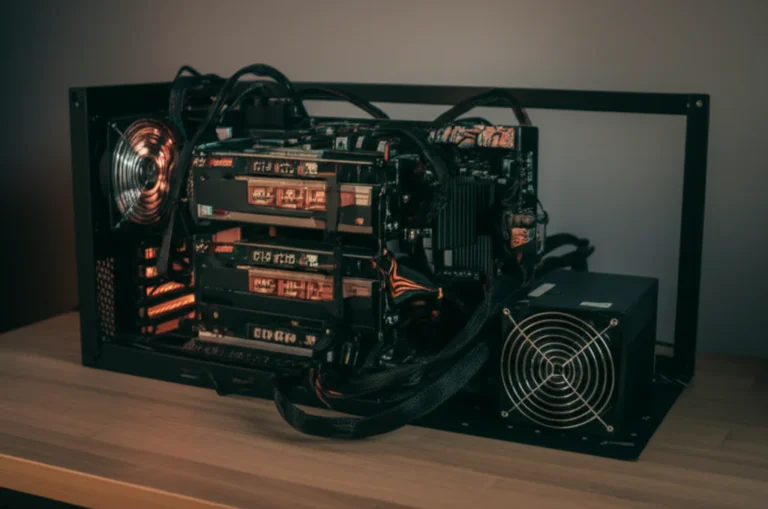

GPU Rigs (The Versatile Option)

For many other cryptocurrencies (altcoins) that are designed to be “ASIC-resistant,” a rig made of multiple powerful graphics cards is the way to go. This is a more feasible entry point for many hobbyists.

- What they are: A custom-built computer with multiple high-end GPUs.

- Pros: ✅ Can mine a wide variety of different coins, and the components can be resold to gamers if mining becomes unprofitable.

- Cons: ❌ Less powerful than ASICs, require more technical skill to build and configure.

- Top Brands: NVIDIA (GeForce RTX series) and AMD (Radeon RX series) are the two main players.

Lottery Miners (The Fun Longshot)

A new category of small, low-power USB miners has emerged for hobbyists. These devices, like the GekkoScience R909 or Bitaxe HEX, won’t earn you a steady income. Instead, they give you a constant, tiny chance to win the block reward lottery. Cointelegraph aptly calls them “digital slot machines.”

👉 Shop for Mining Hardware:

- Bitmain Antminer: Bitmain Official Website

- NVIDIA GeForce RTX GPUs: Amazon | Walmart

- AMD Radeon RX GPUs: Amazon | Walmart

Essential Software and Wallet

- Mining Software: You’ll need software to connect your hardware to the cryptocurrency network. Popular options include CGMiner, BFGMiner (for advanced users), and EasyMiner (for beginners).

- A Secure Crypto Wallet: If you hit the jackpot, you need a safe place to store your earnings! A hardware wallet from brands like Ledger or Trezor is the most secure option for storing significant amounts of crypto.

The Physical Setup

Don’t overlook the environment!

- Power: ASICs require 220v outlets and can dramatically increase your electricity bill.

- Cooling: These machines run hot. You need excellent ventilation or a dedicated cooling solution to prevent them from overheating.

- Noise: An ASIC miner is as loud as a vacuum cleaner. You won’t want it in your living room. A garage or basement is a must.

For a great visual guide on what a larger setup looks like, the video “Can you build a crypto mining farm on your own?” embedded above (#featured-video) provides an excellent overview of the components and scale involved.

1️⃣ Top 7 Best Cryptocurrencies for Solo Mining in 2024

While solo mining Bitcoin is like trying to win the Powerball, there are other Crypto Coins where your odds are significantly better. These are typically coins with a lower network hash rate and algorithms designed to be mined with GPUs. Here are 7 coins that our team believes are worth considering for solo mining adventures in 2024.

- Monero (XMR): A privacy-focused coin that uses the RandomX algorithm, which is designed to be CPU-friendly and ASIC-resistant, leveling the playing field.

- Ravencoin (RVN): Uses the KAWPOW algorithm, which is ASIC-resistant and favors GPU miners. It’s a popular choice for those with gaming rigs.

- Ergo (ERG): Built on the Autolykos2 algorithm, Ergo is another GPU-mineable coin known for its energy efficiency compared to other Proof-of-Work coins.

- Dogecoin (DOGE): Yes, the famous meme coin! While often mined in pools, its Scrypt algorithm is less intensive than Bitcoin’s, and some solo miners have found success. It’s often “merge-mined” with Litecoin.

- Kaspa (KAS): A newer coin that has gained popularity for its efficiency. It uses the kHeavyHash algorithm and can be mined with both GPUs and specialized ASICs.

- Neurai (XNA): An AI and IoT-focused project with a KAWPOW algorithm, making it another solid choice for GPU miners looking for a less crowded network.

- Flux (FLUX): A decentralized cloud infrastructure project that uses the ZelHash algorithm, which is another GPU-friendly option for solo miners.

2️⃣ Step-by-Step Guide: How to Mine Crypto on Your Own Successfully

Feeling brave? Ready to fire up a rig? Here’s a simplified step-by-step guide to starting your solo mining journey.

Step 1: Choose Your Weapon (and Your Coin) Based on the list above and your budget, decide on your hardware (ASIC or GPU rig) and the corresponding cryptocurrency you want to mine. Do your research! Calculate potential profitability based on your hardware’s hash rate, power consumption, and your electricity cost.

Step 2: Get a Secure Wallet Before you earn a single satoshi, you need a wallet address. Download an official wallet for your chosen coin or, for maximum security, set up a hardware wallet like a Ledger Nano X or Trezor Model T.

Step 3: Configure Your Hardware

- For GPU Rigs: Build your PC, install all the graphics cards, and update the drivers.

- For ASIC Miners: Simply plug in the power and ethernet cables.

Step 4: Install and Configure Mining Software Download a compatible mining software (like CGMiner or a GPU-specific miner like T-Rex for NVIDIA). You’ll need to configure it by creating a batch file (.bat) or editing a configuration file. The key piece of information you’ll need is the network’s stratum address, which you can usually find in forums or community guides for your chosen coin. For solo mining, you will be connecting directly to your own node or a solo mining pool.

Step 5: Start Mining! Run the software! A command-line window will pop up, showing your hash rate, temperature, and accepted shares (or, in this case, your progress in solving a block).

Step 6: Monitor and Maintain Keep a close eye on your hardware’s temperature and performance. Regularly clean dust from fans and heatsinks to ensure longevity and efficiency.

⚡ Power Play: Managing Electricity Costs and Environmental Impact

Let’s talk about the elephant in the room: power. Crypto mining, especially with ASICs, consumes a tremendous amount of electricity. This is not just a cost factor; it’s a significant environmental concern.

Calculating Profitability

Your success as a solo miner boils down to a simple equation: (Value of Mined Coins) – (Electricity Cost + Hardware Cost) = Profit

Since the value of mined coins is uncertain (you might mine a block tomorrow or in ten years), the most critical variable you can control is your electricity cost. Use an online crypto mining calculator to input your hardware’s hash rate, power consumption (in watts), and your cost per kilowatt-hour (kWh) to see if a project is even remotely feasible.

The Environmental Debate

The energy consumption of large-scale mining operations is comparable to that of small countries, leading to significant debate and regulatory action.

- E-Waste: The constant need to upgrade to more efficient hardware generates an estimated 24.14 kilotons of electronic waste annually.

- Energy Source: While there’s a growing trend towards using renewable energy, a significant portion of mining is still powered by fossil fuels.

- Regulatory Pushback: Concerns over energy usage have led some regions, like Sweden and Norway, to increase taxes or consider bans on mining.

As a solo miner, your impact is small, but it’s part of a larger picture. Consider using energy-efficient hardware or exploring green energy options if they are available to you.

📉 The Hidden Downsides of Solo Crypto Mining You Should Know

We believe in giving you the full picture at Coin Value™. While the dream of finding a block is exciting, the reality of solo mining is fraught with challenges that go beyond just electricity costs.

- Financial Risk: This is the big one. You could spend thousands on a state-of-the-art ASIC miner and never find a block. The hardware could become obsolete or break down before you ever see a return on your investment.

- Intense Heat and Noise: We’re not kidding. An ASIC miner is not a pleasant houseguest. It requires a dedicated, well-ventilated space where the constant noise won’t drive you or your neighbors insane.

- Technical Complexity: Setting up and maintaining a mining rig isn’t plug-and-play. It requires a good degree of technical know-how, from building a PC to configuring software and troubleshooting network issues.

- Constant Maintenance: This isn’t a “set it and forget it” operation. You’ll need to monitor your equipment, keep it clean, and be ready to replace parts like fans or power supplies.

- Market Volatility: The value of the crypto you’re mining can plummet, turning a potentially profitable venture into a loss-making one overnight.

🌍 Legal Landscape: Where Is Solo Crypto Mining Legal or Banned?

Before you even think about buying hardware, you must check the laws in your country and local jurisdiction. The legal status of cryptocurrency mining is a patchwork of different regulations around the globe.

- Banned or Heavily Restricted: Some countries have outright banned crypto mining due to concerns about capital flight, energy consumption, and financial stability. China’s 2021 ban is the most prominent example.

- Regulated and Taxed: Other regions allow mining but impose heavy taxes or restrictions. Kazakhstan, for instance, increased taxes and limited mining to periods of energy surplus.

- Crypto-Friendly: Some countries have embraced crypto mining, offering cheap electricity and favorable regulations to attract miners.

Disclaimer: We are not legal experts. This information is for educational purposes only. Always consult with a legal professional in your area to understand the specific laws that apply to you.

🤔 Can Anyone Really Mine Crypto on Their Own? Debunking Myths and Realities

So, can a “normal person” do this? Yes… and no. It depends entirely on your goals, resources, and expectations.

The Reality for Bitcoin: For Bitcoin, the dream of a regular person mining a block from their basement is largely a thing of the past. As NerdWallet bluntly states, “For the average person, mining bitcoin at home is unlikely to be profitable.” The industry is dominated by massive, publicly traded companies. A solo operator with one or two machines is a tiny fish in a vast ocean.

The Hobbyist Path: However, if you reframe your goal, the answer changes.

- Are you doing it to learn? ✅ Absolutely! Setting up a small GPU rig or a USB “lottery” miner is a fantastic, hands-on way to learn about blockchain.

- Are you doing it for fun? ✅ The thrill of the “lottery” can be an enjoyable hobby, as long as you treat the hardware cost as a sunk entertainment expense.

- Are you mining a smaller altcoin? ✅ Your chances of success increase dramatically when you move away from giants like Bitcoin to smaller, GPU-mineable coins with less network competition.

The key is to have realistic expectations. Don’t bet your life savings on solo mining Bitcoin. But if you want to support a network you believe in and learn a new skill, it can be a rewarding experience.

🕵️ ♂️ Privacy and Security: Can Solo Crypto Mining Be Traced?

This is a common question, especially for those interested in privacy-centric coins. The answer is nuanced.

- On the Blockchain: Yes, the transaction that grants you the block reward is public and linked to your wallet address. The blockchain itself is transparent.

- Connecting to Your Identity: The link between your wallet address and your real-world identity is the crucial point. As long as you don’t link that address to a KYC (Know Your Customer) exchange, your identity can remain pseudonymous. However, the moment you send those mined coins to an exchange like Coinbase or Binance to cash out into fiat currency, you will have to verify your identity, creating a permanent link.

- Physical Traces: On a more practical level, a sudden, massive spike in your home’s energy consumption could potentially attract the attention of your utility provider or even local authorities, especially in jurisdictions where mining is restricted.

For most solo miners, privacy is less of a concern than profitability and legality. However, if anonymity is your goal, you would need to take advanced operational security measures.

🔧 Maintenance and Troubleshooting: Keeping Your Solo Mining Rig in Top Shape

Your mining rig is an investment, and like any high-performance machine, it needs regular care to run efficiently and last longer.

Routine Maintenance Checklist

- Dusting (Monthly): Dust is the enemy of electronics. It clogs fans and insulates components, causing them to overheat. Use compressed air to clean your rig’s fans, heatsinks, and vents regularly.

- Check Connections (Quarterly): Make sure all power and data cables are securely plugged in. Vibrations can sometimes loosen them over time.

- Software and Driver Updates (As Needed): Keep your mining software and GPU drivers up to date. Updates often include performance improvements and bug fixes.

- Monitor Temperatures (Constantly): Use software like MSI Afterburner (for GPUs) or the ASIC’s built-in interface to monitor temperatures. If they’re consistently high, you need to improve your cooling solution.

Common Troubleshooting Steps

- Rig Crashes or is Unstable: This is often due to overheating or an unstable overclock. Reduce your overclock settings and improve airflow. It could also be a power supply issue.

- Low Hash Rate: This could be caused by outdated drivers, incorrect software settings, or thermal throttling (the hardware slowing itself down to prevent overheating).

- Hardware Not Detected: Ensure the device is properly seated in its slot and that all power connectors are attached. Try reinstalling drivers.

📈 How Long Does It Take to Mine One Bitcoin or Other Coins Solo?

This is one of the most common questions we get, but it’s based on a slight misunderstanding of how mining works. You don’t mine “one Bitcoin.” You mine a “block,” and the reward for that block is a set number of Bitcoins.

As of the 2024 halving, the reward is 3.125 BTC per block.

So, how long does it take to find a block? That depends on two things:

- Your Hash Rate: How much computing power you have.

- The Network’s Total Hash Rate: How much computing power you’re competing against.

Let’s use an example from the Cointelegraph summary. The powerful Antminer S21 Hydro produces about 400 TH/s. The total Bitcoin network hash rate is around 500 exahashes per second (that’s 500,000,000 TH/s).

This means one top-of-the-line ASIC represents about 0.00008% of the network’s power. The odds of that single machine finding the next block are, therefore, astronomically low. Statistically, it could take thousands of years. This is why solo mining Bitcoin is considered a lottery.

For smaller coins, the calculation is the same, but the numbers are much more favorable. With a lower network hash rate, your hardware represents a larger slice of the pie, and your statistical chances of finding a block increase dramatically.

💡 Alternative Mining Strategies: Pools, Cloud Mining, and Hybrid Approaches

If solo mining sounds like too much of a gamble, don’t despair! There are much more practical ways for an individual to get involved in mining.

Mining Pools: Strength in Numbers

This is the most popular and recommended method for home miners.

- How it Works: You “pool” your hashing power with thousands of other miners from around the world. The pool works together to find blocks, and when it does, the reward is split among all participants based on how much work (hash power) they contributed.

- Pros: ✅ Provides a steady, predictable stream of income. Drastically increases your chances of earning rewards.

- Cons: ❌ You have to pay a small pool fee (usually 1-2%). You don’t get the thrill of finding a whole block yourself.

- Major Pools: Foundry USA, AntPool, and ViaBTC are some of the largest pools.

As Cointelegraph puts it, “By joining a mining pool, you combine your hashrate with thousands of other participants. When the pool successfully mines a block, the reward is split based on each miner’s contribution.”

Cloud Mining: Mining Without the Machines

This method allows you to rent hashing power from a large data center.

- How it Works: You pay a company a fee, and they mine cryptocurrency on your behalf with their own equipment. The earnings are deposited into your account.

- Pros: ✅ No hardware to buy or manage. No noise, heat, or electricity bills at your home.

- Cons: ❌ High risk of scams! The space is filled with fraudulent operations. Profits are often thin after fees, and contracts may not be profitable if the market price drops or difficulty rises.

- Reputable (but still risky) Providers: NiceHash and BitDeer have a more established reputation, but extreme caution is still advised.

The consensus is clear: cloud mining is convenient but carries significant risks. As one source notes, “Cloud mining has gained a mixed reputation. Over the years, the space has been flooded with questionable operators, unrealistic return promises and outright scams.”

💬 Real Stories: What We Learned From Solo Miners Around the Globe

Over the years at Coin Value™, we’ve talked to countless miners. Their stories paint a vivid picture of the highs and lows of this pursuit.

The Hobbyist – “Dave the Gamer” Dave had a powerful gaming PC with an NVIDIA RTX 3080. He wasn’t interested in becoming a millionaire; he was just curious. He started mining Ravencoin (RVN) on the side when he wasn’t gaming. “It was never about the money,” he told us. “It was a fun project. I learned so much about wallets, networks, and how it all fits together. The few hundred bucks worth of RVN I mined over a year was just a bonus.”

The Dreamer – “Maria’s Garage ASIC” Maria went all-in. She bought a brand new Antminer S19 and set it up in her garage to solo mine Bitcoin. The noise was deafening, and her electricity bill tripled. For six months, she watched it run 24/7, hoping for that lottery win. It never came. “I was chasing a dream,” she admitted. “The reality is, I was just burning money. I eventually switched my ASIC to a mining pool. The daily payouts are small, but at least it’s something. I wish I’d started with the pool.”

The Lucky One – “Ken’s USB Stick” Ken bought a small GekkoScience USB miner for fun. He plugged it into a Raspberry Pi and let it run, fully aware that his chances of finding a Bitcoin block were practically zero. He mostly forgot about it. Then, one morning, he checked his node and saw the impossible: a block confirmation. He had won the lottery. Ken’s story is the exception that proves the rule—it can happen, but you can’t count on it.

🔚 The Bottom Line: Is Solo Crypto Mining Worth Your Time and Money?

So, we circle back to our original question. After weighing the pros, cons, risks, and rewards, what’s the final verdict from the Coin Value™ team?

Solo mining is worth it IF…

- You are doing it as a hobby to learn about the technology.

- You are mining a less competitive, ASIC-resistant altcoin with a GPU rig.

- You have access to very cheap or free electricity.

- You treat the hardware cost as an expendable expense, not an investment you expect a return on.

Solo mining is likely NOT worth it IF…

- Your primary goal is to make a reliable profit.

- You are trying to solo mine Bitcoin with a small setup.

- You live in an area with high electricity costs.

- You are not prepared for the technical challenges, noise, and heat.

For the vast majority of people looking to earn crypto through mining, joining a reputable mining pool is the far more logical and financially sound strategy. It provides the consistent returns needed to achieve a return on your hardware investment.

Solo mining is a high-risk, high-reward gamble. It’s a thrilling pursuit for the technically savvy hobbyist who understands the odds, but it’s a dangerous path for anyone looking for a steady income. Choose your path wisely

Conclusion

After our deep dive into the world of solo crypto mining, here’s the bottom line from the Coin Value™ team: Yes, you can mine crypto on your own—but it’s a challenging, often costly, and highly competitive endeavor. For Bitcoin, solo mining is akin to buying a lottery ticket with astronomical odds. Unless you have access to massive capital, cheap electricity, and industrial-grade ASIC miners, the chances of striking gold solo are slim.

However, if you’re a hobbyist, a tech enthusiast, or someone passionate about supporting decentralization, solo mining smaller, ASIC-resistant coins with a GPU rig can be a rewarding experience. It’s a fantastic way to learn the ropes, engage with the crypto community, and potentially earn some altcoins along the way.

In summary:

- Positives: Full control over your mining operation, no pool fees, educational value, and the thrill of potentially winning the entire block reward.

- Negatives: High upfront costs, significant electricity consumption, technical complexity, noise and heat issues, and very low odds of solo mining Bitcoin profitably.

If you’re serious about mining Bitcoin or other major coins and want a more consistent income, joining a mining pool is the recommended path. Pools combine hashing power to increase block-finding chances and distribute rewards regularly, making them far more practical for the average miner.

So, if you’ve been wondering whether solo mining is your ticket to crypto riches, the answer is: It can be, but only if you’re prepared for the long haul, the technical challenges, and the financial risks. For most, it’s a journey worth taking for the experience rather than guaranteed profit.

Recommended Links

Ready to gear up or learn more? Here are some trusted resources and products to get you started:

Mining Hardware & Accessories

- Bitmain Antminer Series:

Amazon Search: Antminer | Bitmain Official Website - MicroBT Whatsminer Series:

Amazon Search: Whatsminer | MicroBT Official Website - NVIDIA GeForce RTX GPUs:

Amazon | Walmart - AMD Radeon RX GPUs:

Amazon | Walmart - GekkoScience USB Miners:

Amazon Search: GekkoScience USB Miner

Crypto Wallets for Secure Storage

- Ledger Nano X:

Amazon | Ledger Official Website - Trezor Model T:

Amazon | Trezor Official Website

Recommended Books on Crypto Mining & Blockchain

- Mastering Bitcoin by Andreas M. Antonopoulos — Amazon

- The Basics of Bitcoins and Blockchains by Antony Lewis — Amazon

- Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond by Chris Burniske and Jack Tatar — Amazon

FAQ

What equipment do I need to mine cryptocurrency on my own?

To mine crypto solo, you need:

- Hardware: For Bitcoin, specialized ASIC miners like the Bitmain Antminer S21 or MicroBT Whatsminer are essential due to the network’s massive difficulty. For many altcoins, a multi-GPU rig with NVIDIA or AMD graphics cards suffices.

- Software: Mining software such as CGMiner, BFGMiner, or EasyMiner to connect your hardware to the blockchain network.

- Wallet: A secure crypto wallet (hardware wallets like Ledger or Trezor are best) to store your mined coins.

- Power and Cooling: Reliable electricity supply and adequate cooling solutions to prevent overheating.

- Internet Connection: A stable, low-latency internet connection to maintain network synchronization.

Read more about “How to Mine Bitcoin at Home for Free: 7 Smart Strategies! 💡 …”

Is solo mining more profitable than joining a mining pool?

Generally, no. Solo mining offers the chance to keep the entire block reward, but the probability of finding a block alone is extremely low, especially for Bitcoin. Mining pools aggregate hashing power, increasing the frequency of rewards, albeit smaller and shared among participants. For most miners, pools provide steadier, more predictable income.

Read more about “Crypto Mining at Home: 5 Steps to Success? ⛏️”

How much electricity does solo crypto mining consume?

Electricity consumption depends on your hardware:

- ASIC miners: High-end models like Antminer S21 Hydro consume around 3,000 to 4,000 watts continuously.

- GPU rigs: Varies by number and model of GPUs; a 6-GPU rig might consume 1,000 to 1,500 watts.

Electricity costs often represent the largest ongoing expense. Managing power consumption and sourcing cheap electricity is critical for profitability.

Can I mine Bitcoin on a regular computer by myself?

Technically, yes, but practically, no. The Bitcoin network’s difficulty and competition from ASIC miners make mining on a standard CPU or GPU virtually impossible to earn rewards. You’d be expending electricity with no realistic chance of finding a block.

Read more about “How to Mine Cryptocurrency on PC: 10 Essential Tips for Success 🚀 …”

What are the risks of mining cryptocurrency independently?

- Financial Loss: High upfront hardware costs with no guaranteed return.

- Hardware Failure: Mining equipment can break or become obsolete quickly.

- Electricity Costs: High power consumption can lead to large bills.

- Legal Risks: Mining may be illegal or heavily regulated in your jurisdiction.

- Market Volatility: The value of mined coins can fluctuate wildly.

- Technical Challenges: Requires knowledge to set up and maintain equipment.

How does solo mining impact the value of coins I collect?

Mining adds new coins to circulation and secures the network. Solo mining supports decentralization by distributing mining power rather than concentrating it in pools or large farms. However, solo mining itself does not directly affect coin value; market demand and adoption are the primary drivers.

Are there specific cryptocurrencies better suited for solo mining?

Yes! Coins that are:

- ASIC-resistant: Designed to be mined with GPUs or CPUs (e.g., Monero, Ravencoin).

- Lower network hash rate: Smaller or newer coins where competition is less fierce.

- Using alternative algorithms: Such as RandomX (Monero) or KAWPOW (Ravencoin).

These coins offer better odds for solo miners compared to Bitcoin.

Read more about “The Ultimate Bitcoin Mining Rig: 10 Essential Components You Need to Know … ⛏️”

Reference Links and Resources

- Investopedia: How Does Bitcoin Mining Work?

- NerdWallet: Is Bitcoin Mining Profitable?

- Cointelegraph: How to Mine Bitcoin at Home in 2025: A Realistic Guide

- Bitmain Official Website: https://www.bitmain.com/

- MicroBT Official Website: https://www.microbt.com/

- Ledger Official Website: https://www.ledger.com/

- Trezor Official Website: https://trezor.io/

- NiceHash Cloud Mining: https://www.nicehash.com/

- BitDeer Cloud Mining: https://www.bitdeer.com/

We hope this comprehensive guide from Coin Value™ helps you navigate the exciting, complex world of solo crypto mining. Whether you’re here to learn, experiment, or strike it rich, may your hash rates be high and your electricity bills low! 🚀